All Categories

Featured

Table of Contents

The public auctions are kept in a physical setting or online, and capitalists can either bid down on the rates of interest on the lien or bid up a premium they will pay for it. The investor that approves the least expensive rate of interest or pays the highest costs is granted the lien.

Buyers of residential properties with tax obligation liens require to be knowledgeable about the cost of fixings together with any various other surprise prices that they might encounter if they presume ownership of the home. The brand-new proprietors of these homes may have further legal difficulties, potentially consisting of the demand to evict the current residents with the help of an attorney, a residential or commercial property manager, the local police, or all 3.

How To Start Tax Lien Investing

The city or county treasurer's office will certainly understand when and where the following auction will be held. The treasurer's office will certainly also understand where investors can locate a checklist of property liens that are arranged to be auctioned and the regulations for how the sale will certainly be conducted. These guidelines will certainly outline any preregistration demands, approved techniques of settlement, and other relevant information.

In some cases, the existing worth of the building can be less than the quantity of the lien. Capitalists can assess danger by splitting the face quantity of the delinquent tax obligation lien by the market value of the residential property. Greater ratio computations indicate greater danger. It is essential to inspect for various other liens on the property that will prevent the bidder from taking ownership of it.

Purchasers can look for these liens by number to get info concerning them from the county, which can usually be done online. For each number, the region has the residential or commercial property address, the name of the owner, the evaluated worth of the residential or commercial property, the legal summary, and a breakdown of the problem of the residential property and any kind of structures situated on it.

Regarding 98% of homeowners retrieve the building prior to the foreclosure procedure starts. There have to do with 2,500 jurisdictions cities, towns, or regions that offer public tax financial obligation. Financiers who have an interest in locating tax obligation lien spending chances need to contact the local tax obligation revenue official liable for the collection of real estate tax.

Real estate tax sales are needed to be marketed before the sale - investing in property tax liens. Commonly, the ads provide the proprietor of the residential property, the legal summary, and the quantity of delinquent tax obligations to be offered. The homeowner should settle the capitalist the whole quantity of the lien plus interest, which varies from one state to an additional however is typically in between 10% and 12%

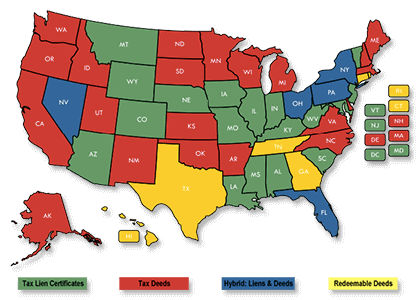

Tax Lien Tax Deed Investing

The repayment timetable usually lasts anywhere from six months to three years. In the large bulk of cases, the proprietor is able to pay the lien completely. If the owner can not pay the lien by the deadline, the investor has the authority to confiscate on the residential property just as the municipality would have.

Capitalists require to come to be extremely acquainted with the real property whereupon the lien has actually been positioned. This can aid them ensure that they will be able to collect the cash from the proprietor. A run-down or abandoned building located in a rundown neighborhood is possibly not an excellent buy, no matter the guaranteed rate of interest.

Characteristics with any kind of environmental damages, like harmful material deposits, are also undesirable. Lien proprietors need to know what their duties want they receive their certificates. Commonly, they need to alert the homeowner handwritten of their purchase within a stated amount of time. They are usually needed to send a 2nd letter of notification to them near the end of the redemption period if payment has actually not been made in complete by that time.

Around 80% of tax lien certificates are offered to NTLA members. To protect membership through NTLA, candidates must pass a background screening process to ensure conformity with the NTLA Code of Ethics. Participants should likewise pay participant charges of varying quantities based upon membership type. Participants can get involved in member-only webinars, earn a Qualified Tax Lien Specialist accreditation, and use the organization's on-line directory site to get in touch with other sector professionals.

Tax obligation liens are normally not ideal for capitalists who have little experience in or expertise of genuine estate. Tax liens are not eternal instruments.

Are Tax Lien Certificates A Good Investment

If the residential property goes into foreclosure, the lienholder might find various other liens on the building, which can make it difficult to acquire the title. Many industrial institutions, such as financial institutions and hedge funds, have come to be interested in residential or commercial property liens. They've been able to outbid the competitors and drive down yields.

There are also some funds currently available that invest in liens, and this can be a great method for a beginner investor to break into this field with a lower level of threat. Investors that acquire tax obligation liens seldom confiscate possession of the building - tax lien investing pitfalls. The lien owner and the residential or commercial property owner get to a contract on a schedule for settlement of the quantity due plus interest.

Property Tax Lien Investing

Twenty-nine states, plus Washington, DC, the Virgin Islands, and Puerto Rico, enable tax obligation lien sales. Typically, after a home owner neglects to pay their taxes, there is a waiting period.

Once the lien has been transferred to the capitalist, the home owner owes the investor the unsettled residential or commercial property tax obligations plus passion. You can call your region's tax collector directly to locate out the process for getting tax liens.

Property owners with delinquent tax obligations normally likewise have impressive home loan financial debt. After acquiring a tax-foreclosed residential property, if you uncover that there is a home mortgage lien on it, it should be eliminated by the area in which you purchased it. The area will release the lien based upon the tax obligation sale shutting records.

In every state, after the sale of a tax lien, there is a redemption period throughout which the owner of the residential or commercial property can attempt to retrieve the residential property by paying the overdue real estate tax. Even if the proprietor is paying their property taxes, the home loan holder can confiscate on the home if the home loan is delinquent.

This is a public paper and acts as a sharp to other lenders that the IRS is asserting a safeguarded case versus your assets. Credit report reporting agencies may find the notification and include it in your credit scores report. Residential property tax liens can be a practical financial investment choice for seasoned financiers acquainted with the realty market.

Latest Posts

Homes Foreclosed Due To Back Taxes

Claiming Foreclosure On Taxes

Houses For Sale On Back Taxes