All Categories

Featured

Table of Contents

The IRS may, nonetheless, be called for to obtain court permission when it comes to bankruptcy; see 11 U.S.C. 362. An IRS levy on a major home have to be accepted in composing by a federal area court judge or magistrate. See Internal Revenue Code sections 6334(a)( 13 )(B) and 6334(e)( 1 ). Section 6334 also gives that particular assets are not subject to an IRS levy, such as specific putting on apparel, gas, furniture and home effects, certain books and devices of trade of the taxpayer's career, undelivered mail, the portion of income, wages, and so on, needed to support small kids, and specific other possessions.

Starting January 1, 2015, the Mississippi Division of Income will sign up tax obligation liens for unpaid tax financial obligations online on the State Tax Obligation Lien Computer System Registry. A tax obligation lien taped on the State Tax obligation Lien Registry covers all residential property in Mississippi.

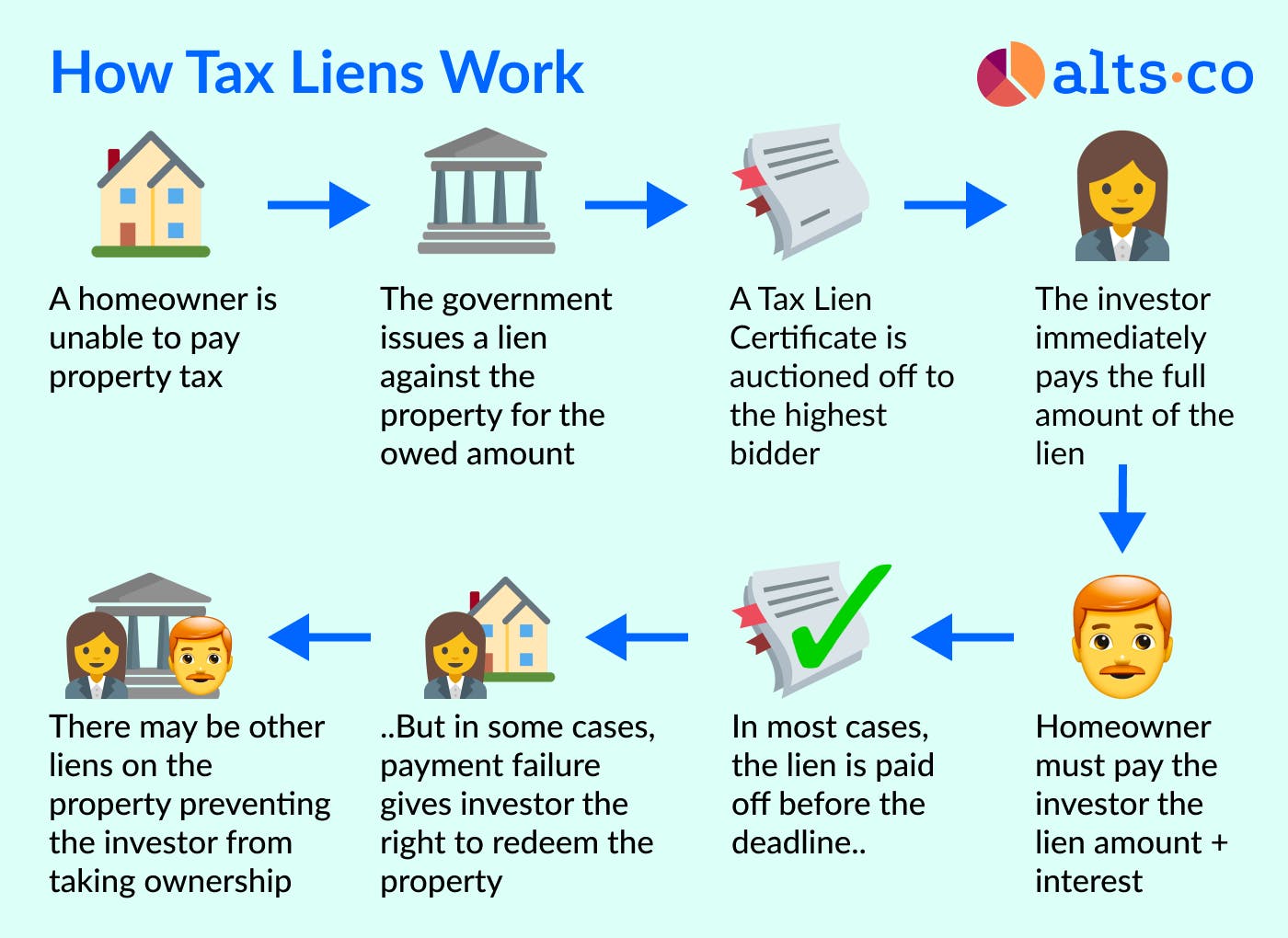

How Do You Invest In Tax Liens

The State Tax Lien Windows registry is a public website easily accessible on the net that might be looked by anybody at any kind of time. Unlike tax obligation returns, tax obligation liens are a public notification of financial debt.

For a person noted on the State Tax Obligation Lien Registry, any kind of genuine or personal effects that the person has or later on obtains in Mississippi goes through a lien. The lien enlisted on the State Tax Obligation Lien Registry does not identify a particular piece of residential or commercial property to which a lien applies.

Tax Lien Investing Florida

Tax liens are listed on your credit history report and lower your credit scores ranking, which might influence your capability to get lendings or financing. Mississippi law allows continuations on state liens until they're paid in full; so continuations can be filed repetitively making a tax lien legitimate forever.

The lien includes the quantity of the tax obligation, fine, and/ or passion at the time of registration. Registration of the tax lien offers the Division a lawful right or interest in a person's residential property until the obligation is pleased. The tax lien may affix to genuine and/or personal effects wherever located in Mississippi.

The Commissioner of Income mails an Analysis Notice to the taxpayer at his last recognized address. The taxpayer is offered 60 days from the mailing day of the Evaluation Notification to either totally pay the assessment or to appeal the analysis - tax lien investing. A tax lien is cancelled by the Division when the misbehavior is paid in complete

Us Tax Liens Investing

If the lien is paid by any kind of various other ways, after that the lien is terminated within 15 days. When the lien is cancelled, the State Tax Lien Registry is upgraded to show that the debt is satisfied. A Lien Cancellation Notice is sent by mail to the taxpayer after the financial obligation is paid in complete.

Enlisting or re-enrolling a lien is not subject to administrative allure. If the person thinks the lien was submitted in error, the person must call the Division of Income promptly and demand that the filing be examined for correctness. The Division of Revenue might request the taxpayer to submit paperwork to sustain his case.

Latest Posts

Homes Foreclosed Due To Back Taxes

Claiming Foreclosure On Taxes

Houses For Sale On Back Taxes